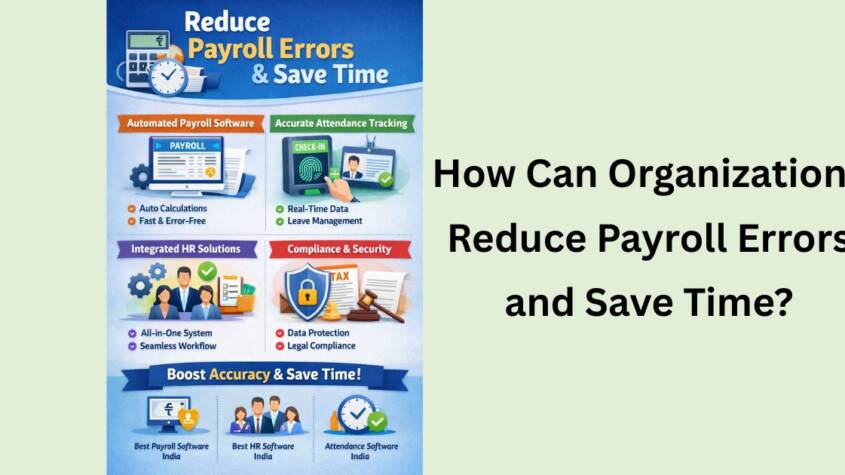

How Can Organizations Reduce Payroll Errors and Save Time?

Building Accurate, Compliant, and Time-Efficient Payroll Processes

Payroll errors are more than just minor mistakes. They can lead to employee dissatisfaction, compliance issues, financial losses, and wasted hours fixing problems that should not have happened in the first place. In India, where payroll rules involve complex tax laws, statutory deductions, and frequent policy updates, managing payroll manually can quickly become overwhelming. Many organizations now look toward smarter systems, including the Best Payroll Software India, to reduce errors and save valuable time within their HR and finance teams.

This article explores the key causes of payroll errors and explains practical ways organizations can simplify payroll processing, improve accuracy, and focus more on strategic work rather than repetitive corrections.

Common Causes of Payroll Errors

Before understanding how to reduce payroll mistakes, it is important to know why they happen in the first place.

Manual Data Entry Issues

Manual payroll processing often involves entering employee details, salary components, deductions, and attendance data by hand. Even a small typing error can lead to incorrect salary calculations.

Inaccurate Attendance and Leave Records

When attendance, overtime, and leave data are not updated correctly, payroll calculations become unreliable. This is especially common in organizations using disconnected or outdated attendance systems.

Changing Compliance Requirements

Payroll in India must follow rules related to PF, ESI, professional tax, income tax, and labor laws. Missing updates or applying incorrect rules can result in penalties and rework.

Lack of Standard Processes

Without standardized payroll workflows, organizations depend too much on individuals. This increases dependency risk and leads to inconsistency when staff members change.

The Impact of Payroll Errors on Organizations

Payroll errors affect more than just numbers on a payslip.

Loss of Employee Trust

Employees expect accurate and timely salaries. Repeated errors reduce trust and harm morale, especially when deductions or reimbursements are wrong.

Increased Administrative Burden

Correcting payroll mistakes takes extra hours every month. HR and finance teams end up spending time fixing issues instead of focusing on employee engagement or planning.

Compliance and Legal Risks

Incorrect statutory calculations or delayed filings can attract fines and legal notices. Over time, this can damage an organization’s reputation.

How Automation Helps Reduce Payroll Errors

Automation is one of the most effective ways to minimize payroll errors while saving time.

Centralized Employee Data

Automated systems store employee information in a single platform. This reduces duplication and ensures consistency across payroll, attendance, and compliance records.

Automated Calculations

Payroll software applies predefined rules for salary structures, deductions, taxes, and benefits. This reduces human dependency and improves calculation accuracy.

Real-Time Updates

Modern payroll systems update calculations automatically when there are changes in attendance, salary revisions, or compliance rules.

The Role of Integrated HR Systems

Payroll does not work in isolation. It depends heavily on HR processes such as attendance tracking, leave management, and employee lifecycle changes.

Seamless Attendance Integration

Using reliable attendance data directly in payroll reduces mismatches. Accurate working hours, overtime, and leave balances ensure fair salary processing.

Employee Self-Service Access

When employees can view payslips, tax details, and leave balances themselves, they can identify issues early, reducing back-and-forth communication.

Unified HR and Payroll Management

Organizations using the Best HR Software in India benefit from integrated workflows that connect hiring, attendance, payroll, and compliance into one system, reducing manual intervention.

Standardizing Payroll Processes

Clear and consistent payroll processes significantly reduce errors.

Defined Payroll Calendar

Having a fixed payroll schedule ensures timely data collection, review, and salary disbursement.

Approval Workflows

Multi-level approvals help catch errors before payroll is finalized. This adds accountability without slowing down the process.

Documentation and Checklists

Maintaining payroll checklists for monthly processing ensures no step is missed, especially during compliance filings.

Improving Attendance Accuracy

Attendance data is a critical input for payroll accuracy.

Digital Attendance Tracking

Modern attendance solutions capture real-time employee work hours, reducing dependency on manual registers or spreadsheets.

Automated Leave Adjustments

Leave approvals automatically reflect in payroll, eliminating manual adjustments and confusion.

Reliable Attendance Systems

Using trusted Attendance Software in India helps organizations ensure accurate work-hour tracking, which directly improves payroll precision.

Training and Knowledge Updates

Technology alone is not enough. Payroll teams must stay informed.

Regular Compliance Training

Payroll and HR professionals should be trained on updated tax laws and statutory requirements to avoid costly mistakes.

Clear Internal Communication

Any changes in salary structure, benefits, or policies should be communicated clearly to both employees and payroll teams.

Data Security and Accuracy Controls

Payroll involves sensitive employee data, making accuracy and security equally important.

Access Controls

Limiting system access based on roles prevents unauthorized changes and reduces the risk of errors.

Audit Trails

Automated systems maintain logs of changes, making it easy to track errors and correct them quickly.

Regular Data Validation

Periodic audits of employee data help identify inconsistencies before payroll processing begins.

Long-Term Time Savings Through Digital Payroll

Reducing payroll errors is not just about accuracy; it is also about saving time month after month.

Faster Payroll Cycles

Automated payroll systems significantly reduce processing time compared to manual methods.

Reduced Rework

When payroll is right the first time, HR teams spend less time handling employee queries and corrections.

Focus on Strategic HR Work

With fewer payroll issues, HR professionals can focus on workforce planning, employee engagement, and organizational growth.

Conclusion

Reducing payroll errors requires a combination of automation, integration, standardized processes, and skilled teams. Organizations that move away from manual methods and adopt digital solutions experience fewer mistakes, improved compliance, and significant time savings. By ensuring accurate attendance tracking, integrated HR workflows, and automated calculations, businesses can build a payroll process that is reliable, efficient, and scalable. Over time, this not only strengthens employee trust but also allows organizations to focus on what truly matters—growth and people development.

Easy tips and tricks to clean your sofa at home

The sofa is the center of your living space. Your sofa is a place where you can relax, ent…