Europe Commercial Drone Market by Weight, System & Application 2026–2034

Europe Commercial Drone Market Size & Forecast 2026–2034

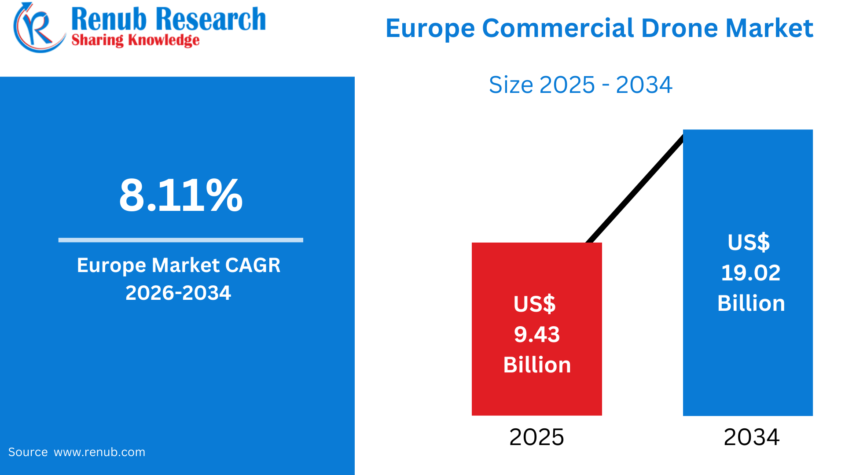

According to Renub Research Europe commercial drone market is poised for strong and sustained expansion during the forecast period of 2026–2034. The market, valued at US$ 9.43 billion in 2025, is projected to nearly double and reach US$ 19.02 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.11%. This growth reflects the rapid integration of commercial drones across multiple industries, including construction, agriculture, logistics, energy, public safety, and environmental monitoring.

The accelerating pace of digitalization across European economies, combined with technological advancements in drone hardware and software, is reshaping how organizations collect data, monitor assets, and automate operations. At the same time, improved regulatory frameworks and rising investments in drone ecosystems are enabling broader adoption and large-scale commercial deployment across the region.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=europe-commercial-drone-market-p.php

Overview of the Commercial Drone Market in Europe

A commercial drone is an unmanned aerial vehicle (UAV) designed specifically for professional and industrial use rather than recreational purposes. Unlike consumer drones, commercial drones are equipped with advanced technologies such as high-resolution cameras, LiDAR sensors, thermal imaging systems, GPS-based navigation, AI-powered flight controls, and automated data collection capabilities. These features allow drones to perform complex and mission-critical tasks, including surveying, mapping, crop monitoring, infrastructure inspection, security surveillance, environmental analysis, delivery trials, and aerial cinematography.

In Europe, commercial drones have gained widespread acceptance due to increasing digitalization and the growing emphasis on smart cities and smart infrastructure. Drones help organizations reduce operational costs, improve workplace safety by minimizing human exposure to hazardous environments, and generate real-time, high-precision data that traditional methods cannot easily provide. Construction companies rely on UAVs for land surveys and progress tracking, energy firms deploy drones for inspecting wind turbines and power lines, and logistics providers test drone delivery solutions, particularly in remote or hard-to-reach locations.

Europe’s strong innovation ecosystem—supported by startups, research institutions, and established aerospace and technology firms—continues to accelerate advancements in drone capabilities. As industries increasingly seek efficient, data-driven, and automated solutions, commercial drones are becoming essential operational tools across the continent.

Growth Drivers in the Europe Commercial Drone Market

Industrial Digitalization and Rising Demand for Data-Driven Operations

One of the primary growth drivers of the Europe commercial drone market is the rapid shift toward industrial digitalization. Organizations across construction, utilities, transportation, mining, and manufacturing increasingly depend on accurate, real-time data to optimize decision-making, enhance safety, and reduce downtime. Drones equipped with advanced imaging sensors, LiDAR systems, and thermal cameras provide highly detailed aerial data that supports infrastructure monitoring, asset management, and predictive maintenance.

Commercial drones are particularly valuable in replacing labor-intensive or high-risk tasks such as inspecting bridges, pipelines, power lines, and wind turbines. By reducing the need for manual inspections, drones significantly enhance workplace safety while improving operational efficiency. The European Union’s emphasis on digital transformation, smart cities, and infrastructure modernization further encourages the adoption of drone technologies across both public and private sectors.

In March 2025, Airbus announced the development of a European-made anti-drone solution called LOAD (Low-Cost Air Defence), highlighting continued innovation and investment in advanced unmanned systems within the region.

Expanding Applications in Agriculture and Environmental Monitoring

Agriculture is one of the fastest-growing application areas for commercial drones in Europe. Farmers increasingly use UAVs equipped with multispectral sensors, thermal cameras, and AI-based analytics to monitor crop health, soil conditions, irrigation efficiency, and pest activity. Precision agriculture enabled by drones allows targeted application of fertilizers, pesticides, and water, reducing costs while supporting sustainable farming practices.

Environmental monitoring is another major growth area. Government agencies, research institutions, and conservation organizations deploy drones to monitor forests, manage habitats, track wildlife, and study climate-related changes. Drones provide low-impact, cost-effective data collection over large or sensitive ecosystems, aligning with Europe’s strong focus on environmental protection and sustainability.

In August 2025, AgEagle Aerial Systems announced the release of the RedEdge-P™ Green multispectral camera, designed to enhance precision agriculture and environmental applications by delivering higher-resolution and more accurate data throughout the crop lifecycle.

Supportive Regulations and Increasing Investments in Drone Ecosystems

Europe has made significant progress in harmonizing drone regulations, particularly through the European aviation framework, which provides clear operational guidelines and facilitates cross-border drone operations. These regulations improve industry confidence by defining requirements related to pilot licensing, operational categories, safety standards, and airspace usage.

In parallel, both public and private investments in drone ecosystems are increasing. Governments are funding research programs, pilot training initiatives, drone corridors, and urban air mobility testbeds. Venture capital investment and collaboration between startups, technology firms, and aerospace manufacturers are accelerating innovation in autonomous navigation, battery efficiency, and payload capabilities.

Autonomous drone operations, including delivery services, emergency response, and smart transportation, increasingly rely on government-backed frameworks. In October 2025, Warsaw-based Orbotix Industries secured €6.5 million to expand its AI-powered autonomous drone systems and manufacturing capacity across the European Union, reflecting growing investor confidence in the sector.

Challenges in the Europe Commercial Drone Market

Regulatory Complexity and Airspace Integration Issues

Despite regulatory advancements, complexity remains a major challenge for the European commercial drone market. While overarching frameworks exist, interpretation and implementation can vary between countries, creating challenges for cross-border operations. Compliance with requirements related to pilot certification, flight permissions, operational categories, and no-fly zones can increase administrative burdens and costs.

Urban drone operations, particularly beyond visual line of sight (BVLOS), face stringent safety requirements. Integrating drones into existing airspace alongside manned aviation and urban infrastructure presents both technical and administrative challenges, potentially slowing large-scale deployment.

Technical Limitations and Public Privacy Concerns

Commercial drones continue to face technical constraints related to battery life, payload capacity, weather resistance, and flight endurance. While innovation is ongoing, certain long-range or heavy-duty industrial missions remain challenging. Additionally, public concerns around privacy, noise, and safety influence adoption, particularly for surveillance-related applications.

Compliance with Europe’s strict data protection and privacy regulations is essential. Building public trust through transparent operations, secure data handling, and responsible use remains critical for the long-term success of commercial drone deployment.

Europe <2 kg Commercial Drone Market

The <2 kg segment is among the fastest-growing categories in the European commercial drone market. Lightweight drones are affordable, portable, and easier to license, making them attractive to small businesses, surveyors, agricultural consultants, and media professionals. Their compact size allows operation in urban and confined environments where heavier drones face restrictions.

Rapid innovation in camera quality, flight stability, and autonomous features continues to enhance this segment. Improved battery performance enables longer and more reliable missions, ensuring sustained dominance due to accessibility and versatility.

Europe Commercial Drone Hardware Market

The hardware segment forms the backbone of the European commercial drone industry, encompassing airframes, sensors, cameras, batteries, and payload systems. Continuous advancements in LiDAR, thermal imaging, AI-enabled processors, and lightweight materials are improving accuracy, range, and efficiency.

European manufacturers and global drone brands are developing specialized hardware solutions for agriculture, inspection, security, and logistics. Although capital-intensive, hardware innovation is essential for delivering high-performance drone solutions across industries.

Europe Fixed-Wing Commercial Drone Market

Fixed-wing drones play a crucial role in long-range applications such as environmental monitoring, border surveillance, forestry management, and large-scale agricultural analysis. Their aerodynamic design enables longer flight endurance and broader area coverage compared to multi-rotor drones.

While fixed-wing UAVs require more space for takeoff and trained operators, their efficiency and data coverage make them indispensable for large-scale commercial missions.

Europe Semi-Autonomous Commercial Drone Market

Semi-autonomous drones combine manual oversight with automated features such as waypoint navigation, obstacle detection, and return-to-home functions. This segment is growing rapidly due to its balance between efficiency, safety, and regulatory acceptance.

These drones reduce pilot workload, improve accuracy, and enhance mission reliability, making them ideal for mapping, inspection, and delivery applications.

Europe Mapping and Surveying Commercial Drone Market

Mapping and surveying represent one of the strongest use cases for commercial drones in Europe. Equipped with high-resolution cameras, LiDAR sensors, and photogrammetry software, drones generate precise 2D and 3D maps for construction, mining, land development, and environmental studies.

Drone-based surveying significantly reduces project timelines and costs while improving safety. The adoption of digital twins and smart infrastructure further drives demand for UAV-enabled mapping solutions.

Europe Commercial Drone Agriculture Market

Agriculture remains one of the most promising long-term applications for commercial drones. European farmers use UAVs for crop monitoring, disease detection, irrigation optimization, and nutrient management. Targeted spraying reduces environmental impact and operational costs.

As agriculture faces challenges related to climate change and productivity, drones provide actionable insights that support sustainable farming and yield improvement.

Europe Security and Law Enforcement Commercial Drone Market

Security and law enforcement agencies increasingly deploy drones for surveillance, crowd monitoring, traffic management, and search-and-rescue operations. Equipped with thermal and night-vision cameras, drones provide real-time situational awareness while minimizing risk to personnel.

Despite privacy concerns, responsible use and clear regulations support continued adoption across Europe.

Country-Level Insights

France leads the European commercial drone market, supported by aerospace expertise, innovation-friendly policies, and strong adoption across agriculture, energy, construction, and public safety.

Italy shows growing adoption in agriculture, cultural heritage preservation, and infrastructure inspection.

The United Kingdom remains one of the most mature markets, driven by strong regulations, government support, and a vibrant startup ecosystem.

Market Segmentation Overview

The Europe commercial drone market is segmented by weight, system, product type, mode of operation, application, end use, and country. Key companies include AeroVironment, Autel Robotics, Delair, PrecisionHawk, Skydio, and Yuneec.

Conclusion

The Europe commercial drone market is entering a decisive growth phase, driven by digital transformation, expanding industrial applications, supportive regulations, and technological innovation. While challenges related to regulation, technical limitations, and public perception remain, continued investment and innovation position commercial drones as indispensable tools across Europe’s economy. Through 2034, commercial drones are expected to play a central role in improving efficiency, safety, sustainability, and data-driven decision-making across industries.

Merchant Hydrogen Market Size & Forecast Analysis, 2030 | UnivDatos

According to UnivDatos, rising demand for clean energy, government incentives and funding …