Financial Reporting Automation: Where AI Handles Complexity

financial reporting automation

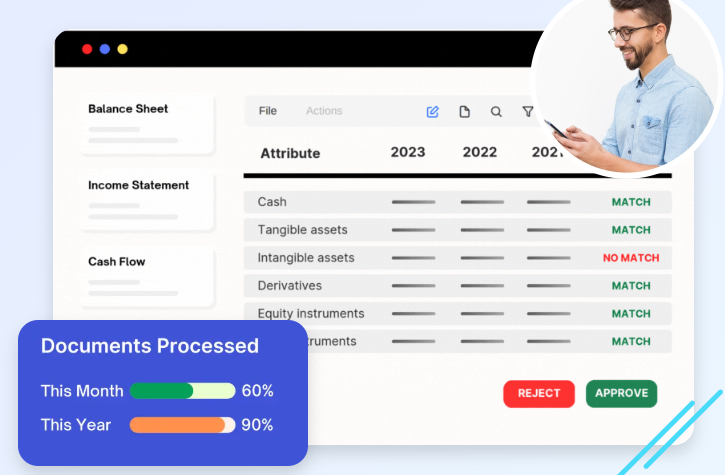

Financial reporting demands precision, speed, and actionable insights. Yet traditional methods often leave analysts bogged down in spreadsheets, PDFs, and scanned documents, consuming hours to extract, classify, and reconcile data. Mistakes creep in, review cycles extend, and decision-making slows. Financial reporting automation provides a more innovative approach, enabling AI to handle complexity and deliver structured, reliable data ready for analysis.

The Limits of Traditional Financial Spreading

Manual financial spreading relies heavily on human effort. Analysts spend significant time copying numbers, reconciling inconsistencies, and organizing data from multiple document types. Spreadsheets can break easily, templates can fail with minor changes, and missing values often require tedious investigation. Even experienced teams can struggle to maintain speed and accuracy.

Financial reporting automation addresses these challenges by streamlining data extraction, classification, and reconciliation, reducing errors and freeing analysts to focus on insights rather than manual tasks. This labor-intensive process slows decision-making and increases the risk of mistakes, but automation ensures data consistency and reliability. Delays ripple through an organization, affecting credit evaluations, risk assessments, and operational decisions. When financial data is inconsistent or difficult to verify, confidence in reports diminishes, making stakeholders hesitant to take action.

Common Pain Points in Manual Reporting

Several recurring issues make manual financial reporting cumbersome:

- Time-intensive extraction: Pulling data from PDFs and Excel sheets is repetitive, slowing review cycles.

- Broken templates: Static templates fail under minor changes, resulting in frequent rework.

- Unclear data lineage: Tracing numbers back to their sources is challenging, which reduces trust.

- Multilingual challenges: Reports in multiple languages require manual adjustments, increasing the likelihood of mistakes.

These challenges divert analysts from interpreting results and identifying insights. Automation addresses these problems by extracting, classifying, and reconciling data across structured, semi-structured, and unstructured sources. Analysts can focus on insight rather than raw numbers, improving both efficiency and confidence in reporting outcomes.

How AI Transforms Financial Reporting?

AI brings transparency, consistency, and reliability to financial reporting. Advanced algorithms consistently map data accurately, detect discrepancies, and maintain full traceability of every figure. Analysts gain confidence that each number aligns with its source, enabling faster, safer credit analysis, risk evaluation, and strategic planning. Key AI capabilities include:

- Flexible templates: Adapt to document changes without breaking workflows.

- Centralized document management: Store statements, tax returns, and reports in one secure location.

- Multilingual processing: Automatically recognize local number and date formats across different languages.

- Transparent lineage: Track every number back to its source, ensuring accuracy and audit readiness.

These capabilities eliminate bottlenecks, expedite reporting, and ensure high-quality outputs with minimal manual effort.

Measurable Benefits for Teams and Analysts

Implementing AI-driven financial reporting automation provides clear, tangible advantages:

- Improved Efficiency

AI drastically shortens processing time. Tasks that previously took hours are now completed in minutes, freeing analysts to focus on higher-value activities, such as trend analysis, forecasting, and risk assessment. Teams can handle larger volumes of financial data without increasing headcount, improving overall productivity.

- Reduced Errors

Manual processes are prone to mistakes, from misentered numbers to misaligned formats. Automation ensures consistent, accurate data mapping and validation, dramatically reducing errors. Accurate reports enhance decision-making confidence and build trust across the organization.

- Less Rework

Automation standardizes workflows, reducing the frequent corrections required in manual reporting. Analysts spend less time fixing errors and more time interpreting results that drive business outcomes.

- Faster Decision-Making

With automated reporting, data is processed quickly and reliably, enabling faster responses to operational and financial demands. Decisions that previously took days can now be made in hours, supporting timely risk management, credit approvals, and strategic planning.

- Enhanced Audit Readiness

Automation maintains a complete trail of every number, ensuring transparency and compliance. Audit processes become faster and more streamlined, allowing teams to respond confidently to queries or regulatory requests.

Making AI Work for Your Organization

For organizations dealing with large volumes of financial data, automation is no longer optional, it’s essential. Financial reporting automation transforms labor-intensive processes into streamlined, reliable workflows. Analysts maintain control over strategic decisions while AI manages repetitive, error-prone tasks.

Features like real-time review, flexible templates, and multilingual processing keep operations agile and accurate. Analysts can focus on insights, trends, and opportunities, while routine extraction, reconciliation, and classification are handled automatically. This leads to faster reporting, stronger decision-making, and increased operational confidence.

Real-World Impact

Organizations implementing AI-driven reporting observe immediate improvements:

- Analysts spend more time analyzing trends and less time on manual data entry.

- Financial statements are processed more efficiently and accurately, thereby reducing bottlenecks and improving overall workflow.

- Errors are minimized, and rework is rare, freeing teams to focus on high-value insights.

- Decision-makers can act quickly with confidence in the underlying data, improving responsiveness to market and operational conditions.

These outcomes translate to a competitive edge. Faster and more accurate reporting enables organizations to identify opportunities sooner, manage risks more effectively, and optimize operational performance.

Conclusion

Financial reporting no longer needs to be slow, error-prone, or tedious. AI-powered automation redefines what’s possible, enabling analysts to focus on interpreting insights with spreadsheets and PDFs. By automating extraction, reconciliation, and classification, organizations gain faster reporting, higher accuracy, and robust audit trails.

For businesses handling complex financial data, automation is the key to efficiency, reliability, and better decision-making. Teams can operate more efficiently, insights arrive sooner, and reporting becomes transparent and traceable, fostering more substantial confidence in every decision.

Financial reporting automation streamlines workflows, automates repetitive tasks, and enables analysts to focus on the work that truly drives value. Complexity no longer slows progress; AI handles it with precision, clarity, and speed.

Easy tips and tricks to clean your sofa at home

The sofa is the center of your living space. Your sofa is a place where you can relax, ent…